OBJECTIVE

In this video, I explain the differences in position sizing between forex and futures trading. In forex, you can start with a minimum of 0.01 lots and scale up based on your comfort level and account balance. However, in futures, you can only trade in whole contracts, with no decimals allowed, which means you must trade in multiples of one. I encourage you to explore your relevant forex or futures pairs and start with the lowest available size to get a feel for your trading strategy.

Introduction to Position Sizing 0:00

- Overview of the video topic: Difference between position sizing in Forex and Futures.

- Importance of understanding position sizing for traders.

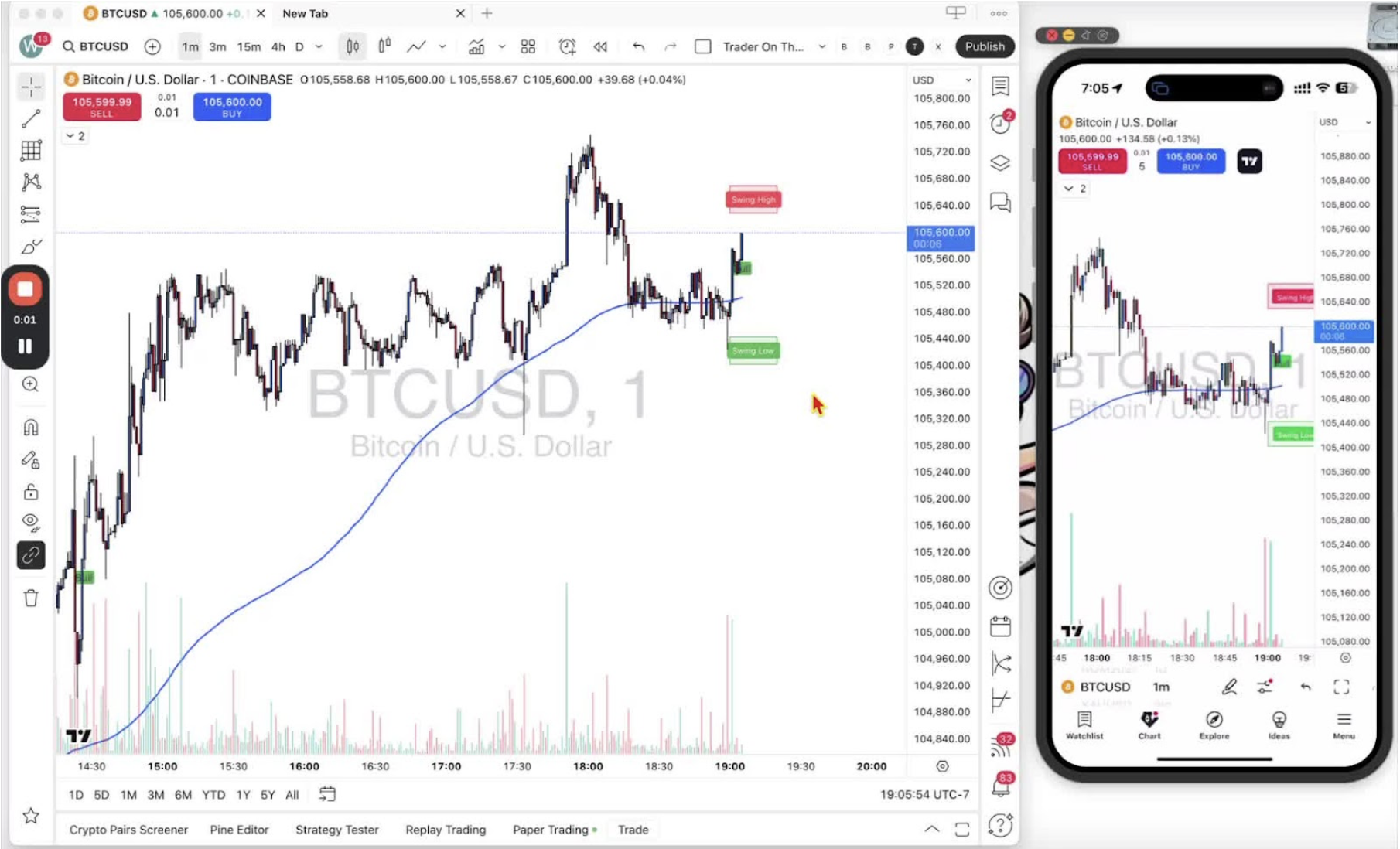

Position Sizing in Forex 0:00

- Forex allows the use of decimals in position sizing.

- Minimum position size starts at 0.01.

- Traders can scale up from 0.01 to higher amounts based on broker limits and account funds.

- Recommended approach: Start with 0.01 in a paper trading account to test and gain comfort.

Experimenting with Forex Position Sizes 0:38

- Gradually increase position sizes (e.g., 0.02, 0.03) to find comfort levels.

- Focus on balancing risk with available funds in the paper trading account.

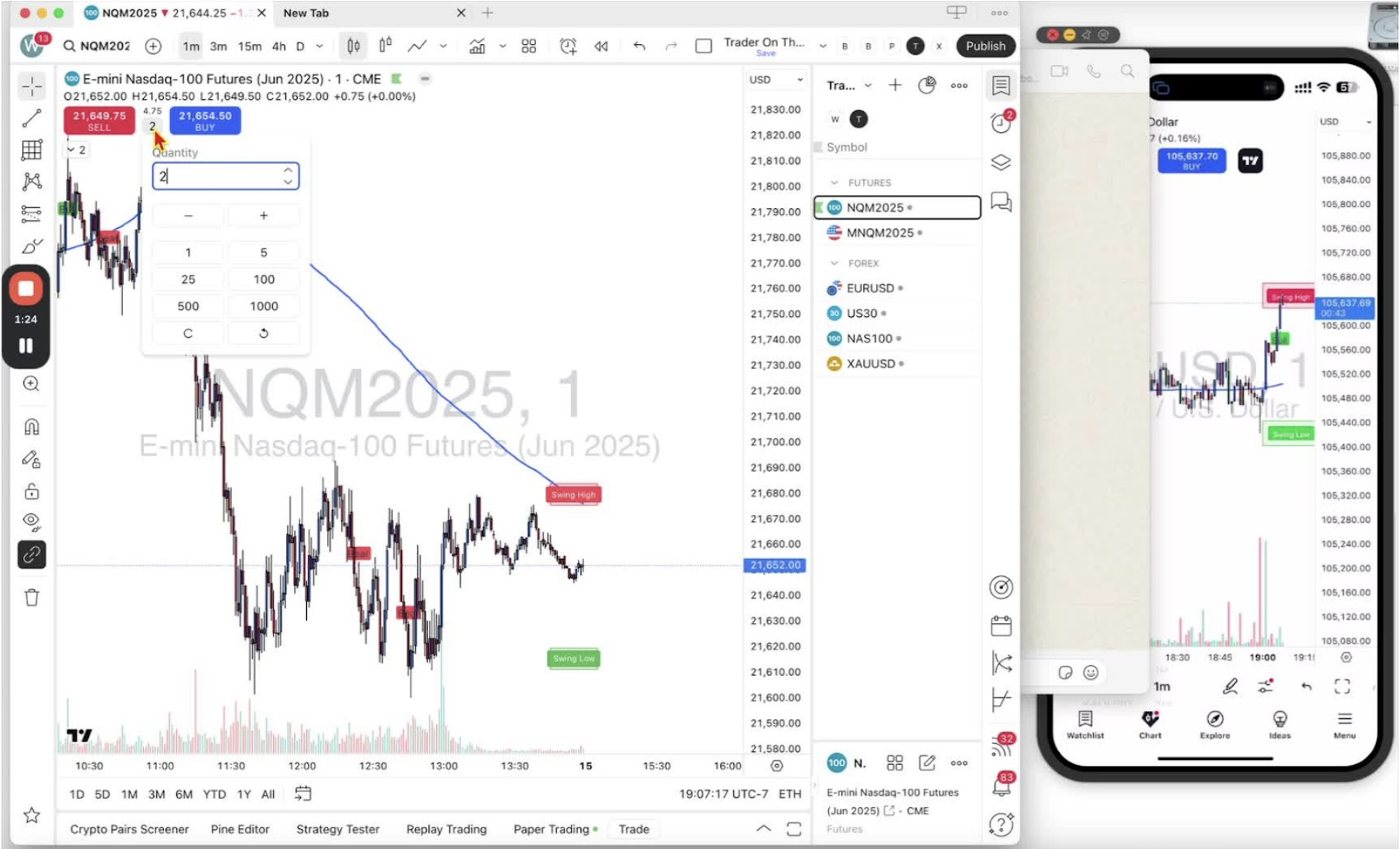

Position Sizing in Futures 0:54

- In Futures, position sizing is limited to whole numbers (multiples of one).

- No decimals are allowed in contract sizing

Understanding Futures Contracts 1:09

- Explanation of contract types: NQM and MNQ.

- Distinction between mini contracts (higher leverage) and micro contracts.

Conclusion and Recommendations 1:32

- Simplest way to explore position sizing is to start with the lowest available size in either Forex or Futures.

- Encourage traders to familiarize themselves with their specific Forex or Futures pairs.